New Suggestions For Choosing Refinansiere Boliglån

Wiki Article

Consumer Loans Can Be Used To Finance A Wide Range Of Needs.

Consumer loans are used for many purposes dependent on the requirements of each person and their financial situation. A few common reasons for using consumer loans are: Consolidation of Debts- Combining a variety of debts into one loan to make payments easier and possibly reduce the rate of interest.

Home Improvements - This is the funding of home improvements or repairs.

Auto Purchases- This is buying a vehicle new or used, with auto loans or personal loans.

Educational Expenses (Books, tuition or any other education expense)

Medical Expenses - Paying medical bills, procedures or other unanticipated medical expenses.

Personal expenses finance personal expenses such as weddings, travel or other significant expenses. View the recommended Søk Forbrukslån for blog tips including din bank, boliglån rente kalkulator, søk boliglån, lån på dagen, raske lån, refinansiering av forbrukslån, søk refinansiering, kalkulator boliglån, lån forbrukslån, lav rente forbrukslån and more.

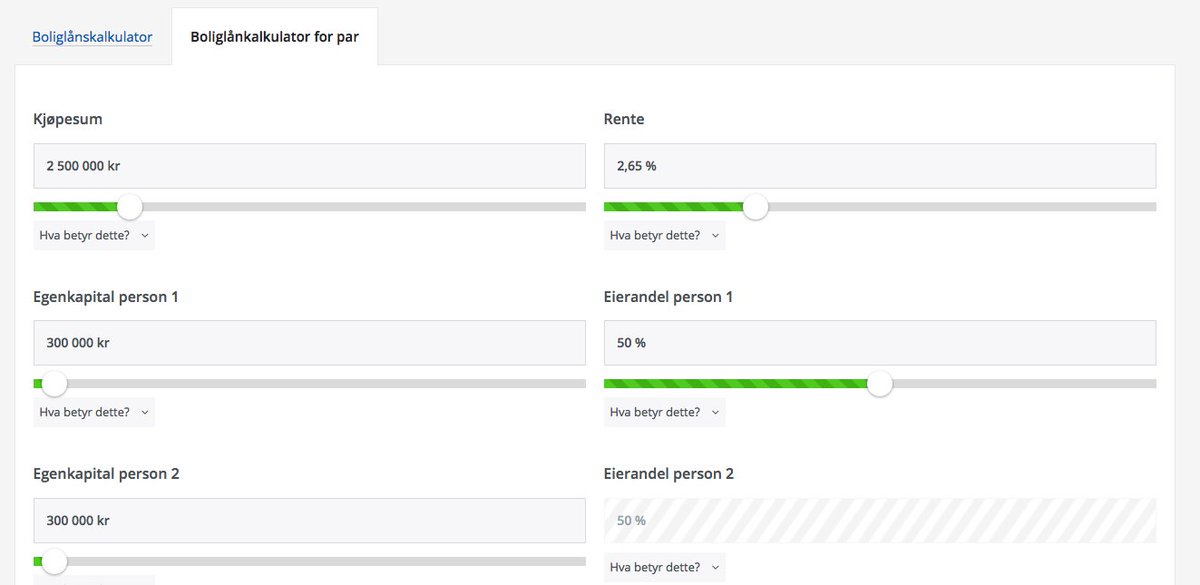

What Exactly Is A Mortgage Calculator, And How Accurate And Useful Is It?

Calculators for mortgages are financial tools which estimate mortgage payments by considering a variety of factors including the amount of the loan, interest rates, loan terms, and other costs, like property taxes and insurance. It helps people assess their financial capacity and plan their home expenses. Be aware of these elements:

Estimation monthly payments: Mortgage calculators calculate the estimated monthly payment based on input data. To get a more comprehensive estimate, they include not only principal and interest. They could also include in homeowners' insurance, property taxes insurance, and Private Mortgage Insurance (PMI).

Accuracy in Information: The accuracy of the calculator's results are dependent on the accuracy of the data input. Calculated results might not be accurate if the interest rate, loan amount, or other details provided are inaccurate or out of date.

Mortgage Calculators are restricted in terms of their application. They offer an estimate and do not take into account the entire financial picture or change elements, such as the rate of interest, property tax or insurance costs in time.

Educational Tool - They are useful educational tools which let the user experiment with various scenarios. Users can adjust parameters to comprehend the consequences of the changing terms of loans such as down payments, or overall cost.

Calculators for mortgages are an excellent tool for comparing different loan terms and options. It helps you make informed decisions about the various mortgage options.

Consultation with a professional - Although mortgage calculators online are helpful for estimating your needs, you should consult with experts to gain better understanding of your options when it comes to loans such as qualifying criteria, individual financial circumstances.

Mortgage calculators provide a quick way to study various possibilities and estimate mortgage payments. To obtain precise information and receive specific advice, especially in regards to mortgage approval, current rates and terms for your loan, speak with a financial advisor. Follow the top rated Boliglånskalkulator for more examples including uno finans, lån bolig, låne kalkulator, slette betalingsanmerkning, best rente forbrukslån, rente boliglån, søk om refinansiering, boliglånskalkulator hvor mye kan jeg låne, oppusing lån, refinansiere boliglån kalkulator and more.

How Is Credit Score Calculated And How Is It Incorporated Into The Approval Of A Loan?

Credit scores play an important element in loan approval. They're calculated based on a variety of elements. While different credit bureaus may differ in their algorithm, these are the main factors that generally influence credit score calculations: Payment History (35%)The most crucial aspect, the payment history, assesses whether you've paid previous credit accounts punctually. This section is negatively affected by late payments, defaults or bankruptcy.

Credit Utilization (30 percent)- This factor examines the amount of credit you're utilizing compared to your available credit limits across all accounts. Lower ratios of credit utilization result in better scores.

The length is your credit history (15 15 percent). Credit histories that are longer show responsible management of credit.

Types and Amounts of Credit used (10%) The fact that you have different kinds of credit like installment loans or credit cards can improve your score by proving you manage your credit differently.

New Credit Requests (10 percent): Opening new credit cards in short time can adversely affect your score. Every credit report that includes the hard inquiry could result in a small drop in your score.

Credit scores are one of the primary factors in evaluating the creditworthiness of a potential applicant. A greater credit score is linked to lower default risk and is a way to get better loan terms.

Credit scores are considered by lenders in addition to other aspects such as your income, work history, and debt-to-income-ratio as well as the goal of the application. The criteria for scoring differs between lenders. Credit scores are typically higher, which increases the likelihood of getting approval.

If you want your credit score to remain high, responsible management is necessary. This means paying on time payments on credit, coordinating the types of credit you use, and keeping credit utilization at a minimum. It is possible to improve your credit score by monitoring your report regularly and correcting any errors. See the best Refinansiere Boliglån for more advice including refinansiering lavest rente, boliglån rentekalkulator, kortsiktige lån, søknad om lån, lån og renter, lån uten sikkerhet med betalingsanmerkning, beregne lånekostnader, refinansiere kredittkort, boliglån rente kalkulator, forbrukslån lav rente and more.